You’ve heard the saying “The Rich Get Richer”. It is usually uttered in a negative manner to hint that only the rich get richer and the rest only get poorer. In this blog we do not pull other people down for their successes. Instead we try to learn from others who’ve done well and apply it to improve our life.

Source: Quickmemes

An Early Retiree is also a “Rich” person who has accumulated a lot of capital by aggressively saving their salary for 10-15 years. So let’s try to understand how “The Early Retiree Can Get Richer” by listing out the many ways in which the Rich use their accumulated capital to their advantage.

You can implement some of these strategies even now before fully accumulating your retirement corpus.

Table of Contents:

- The Early Retiree pays no interest for loans

- The Early Retiree pays no tax on stock market profits

- The Early Retiree gets huge discounts on purchases

- The Early Retiree travels for free

- The Early Retiree earns higher interest than F.D

The Early Retiree pays no interest for loans

I bought my apartment using my savings. I did not take a home loan. If I had taken a home loan the apartment would have cost double from paying the bank EMI interest.

As an Early Retiree if you save up and then buy an apartment using savings you enjoy the same privilege enjoyed by rich people who pay the entire cost upfront from their bank accounts instead of taking loans.

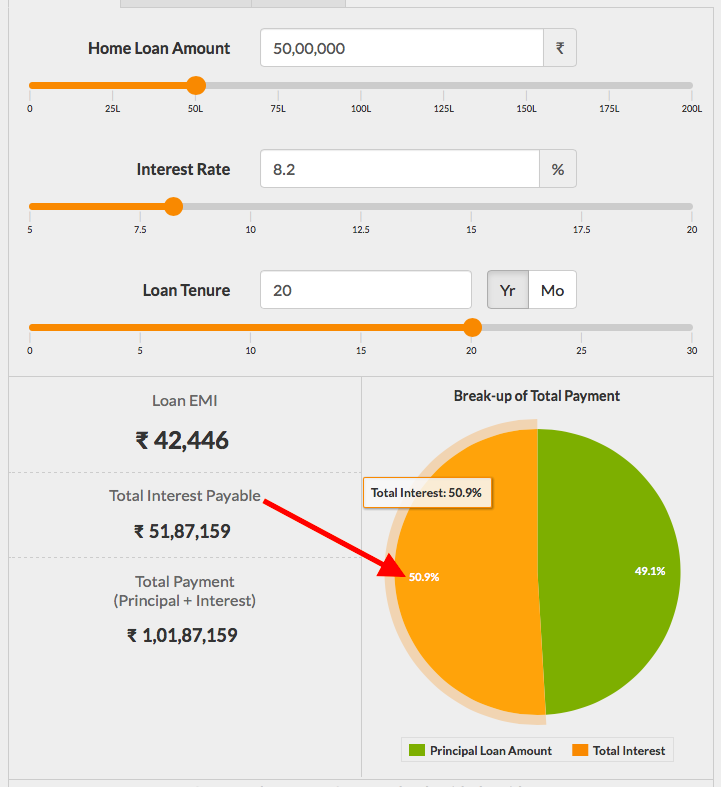

See the EMI Calculator below that shows how EMI interest is almost 50% of the total loan repayment. For a house you purchased for Rs.50 lakhs you’ll end up paying Rs.1 crore with interest over the course of the loan repayment period.

For example:

If you bought a house at Rs.50 lakhs without loan then selling it at say Rs.60 lakhs after 2 years gives you a gain of Rs.10 lakhs. But someone who took a loan like in the above graphic to buy the same house would have paid EMI interest of Rs.10 lakhs in 2 years so when they sell it for Rs.60 lakhs after 2 years their gain is zero. Refer the year-by-year EMI payment at the bottom of this EMI Calculator page.

The Early Retiree pays no tax on stock market profits

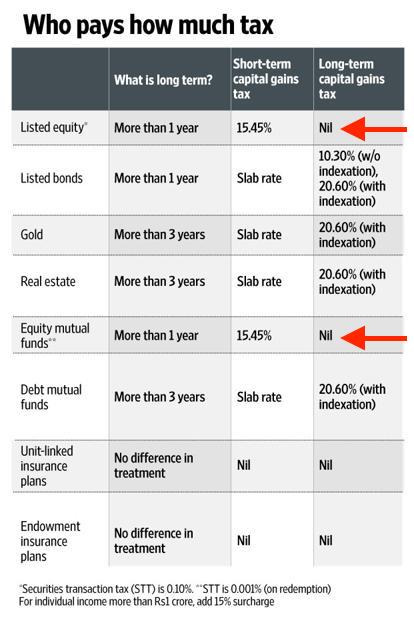

The Early Retiree pays ZERO TAX in India on stock market profits if they’ve held the equity shares or equity mutual fund units for more than 1 year. Even dividend income from equity shares is exempt from tax in India.

Assume you have accumulated a corpus of Rs.1 crore which generated a 12% annual return last year. That is Rs.12 lakhs annual profit on which you don’t have to pay any tax. You could use it towards purchasing other non-financial assets like a house, car, gold, kid’s education etc without taking any loan EMI.

A PLEASANT SIDE-EFFECT:

By using tax-free stock market profits to buy other assets as part of your annual portfolio rebalancing you are actually diversifying your portfolio into real-estate, gold, F.D etc. thereby reducing the risk of capital loss in your portfolio if you had instead kept all your investments in only the stock market.

Successive governments in India have considered imposing a long-term capital gains tax on equity shares and equity mutual funds but for now there is no tax. Leverage it to your advantage by retiring early 🙂

The Early Retiree gets huge discounts on purchases

Real Estate discounts of 10-30% at BANK AUCTIONS :

I personally know of a person who bought a flat in a prime residential area for a great bargain through bank auction.

Banks like SBI regularly auction off properties where the borrower has defaulted on their home loan. The bank is primarily interested in recovering the loan amount they are owed and not in ensuring they get the maximum market value for the house.

This is a great opportunity for the Early Retiree sitting on cash or easy to liquidate assets like equity & F.D. Being liquid is important to participate in bank auctions because you need to deposit 10-15% of the bid amount upfront to prove that you are a serious bidder. If you win your bid then you have to pay the full amount within 15 days.

See :

- BankEAuctions.com : List of ongoing auctions and bid prices

- Properties sold by banks through e-auctions are generally offered at a 10 to 15 per cent discount

- Bank Auctions – The Cheaper & Smarter Way to Buy Your Dream House

Health & Car Insurance Discounts:

ICICI Lombard Health Insurance offers a 35% discount on the annual premium if you opt to pay a deductible of Rs. 1 lakh. The insurer is telling you: “Hey! if you pay out of your own pocket for upto Rs.1 lakh in expenses then we’ll will give you a 35% discount on the annual premium”

For an early retiree sitting on a huge savings corpus, paying Rs.1 lakh on rare years won’t pinch them that much. On all other years they enjoy a low premium! That’s what rich people would do. Since your health insurance premiums only increase as you grow older this is a great way to keep those costs down.

Same principle applies for car insurance too. Opt to pay for minor dents & repairs yourself to lower your premium.

Don’t file a claim for minor issues so you can get a no-claim bonus the following year.

The Early Retiree travels for free

The typical Early Retiree pays off their credit card bill in full every month and therefore has a great credit score. Because they have a great credit score they are eligible for credit cards that give fantastic travel points which they can use to get at-least one FREE domestic round-trip flight for two every year more than making up for the annual fee charged by these cards. They also travel in style like rich people by getting access to airport lounges while they wait for their flight.

Simply swipe your monthly expenses on these travel credit cards and pay them off in full every month. Paying each month’s bill in full means you don’t even have to care about the interest rate charged by these cards.

| Card Name | Free Flight Tickets worth Rs.15,000 |

| American Express® Platinum Travel Credit Card | Spend Rs.4 lakhs/year on card |

| Axis Bank Miles Privilege Credit Card | Spend Rs.7.5 lakhs/year on card |

| CITI PREMIERMILES® CREDIT CARD | Spend Rs.9 lakhs/year on card |

High-level Details on how the rewards work:

| Card Name | Annual Fees | Earning | Redeeming |

| American Express® Platinum Travel Credit Card | ₹5,000 | Spend Rs. 1.90 Lacs in a year and you can get Travel Vouchers worth more Rs. 7,700 Spend Rs. 4 Lacs in a year and additionally you can get Travel Vouchers worth Rs. 11,800 |

|

| Axis Bank Miles Privilege Credit Card | ₹1,500 | Yatra Vouchers worth Rs. 5,000 every time Rs. 2,50,000 is spent on the card | |

| CITI PREMIERMILES® CREDIT CARD | ₹3,000 | Earn 4 Miles for every Rs.100 spent | 100 Miles = Rs.45 |

The Early Retiree earns higher interest than F.D

The Early Retiree has accumulated a large retirement corpus. Some of it is in F.D. The Fixed Deposit (F.D) gives him only 6% interest today and trending lower. Say family member or friend who is trustworthy needs a loan for business or kid’s education.

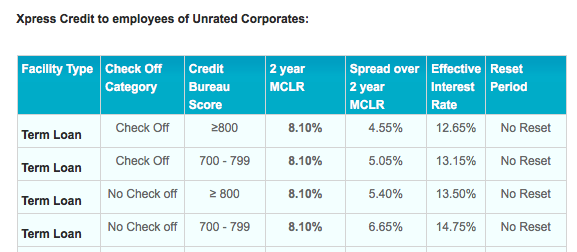

- SBI charges a really high 13% interest for Personal Loans even for someone with the highest credit score. See personal loan interest rates table below.

- My bank F.D today gives only 6% interest

- Instead I can loan my friend the money at 9% interest if I trust them to repay or against collateral.

- My friend gets it for 4% less than what the bank charges him and I get an interest rate 3% higher than what my bank pays for my F.D Win-Win

Here’s a good article on the Precautions to take while lending to friends and family

If you would rather not risk your friendship or relationship over lending money then there are RBI-regulated P2P lending portals are available in India. So the Early Retiree has more options to lend her money and get higher interest.

thanks for the encouragement sahil. I’ll be writing more about lifestyle expenses next as I’ve been writing mostly on investment topics so far. After all we do early retirement for quality of life reasons 🙂

Very well written and articulated blog. Good job and keep up the good work.