Lot of people have asked us questions about our lifestyle as well as our cost of living such as- How much it costs to live in Goa? Or How often do you eat out? etc..These are very valid questions. However till now we were shying away from sharing our detailed cost of living in Goa, India publicly primarily for following reasons:

- We are very private people.

- We were concerned about people judging our lifestyle. (I guess no one enjoys criticism)

Why the change of heart?

But over the years we have grown confident in our choices. More-so sharing our life through this blog has made us little more open. Most importantly through this blog we came into contact with a lot of good people that we feel the question about our expenses is NOT judgemental but sincere.

On this blog we have published stories of Anil and Mahesh where they shared their lifestyles with all of us. And we found their interviews very useful.

So now at this point we feel comfortable enough to divulge our detailed cost of living on this blog. Hoping that somehow it helps fellow F.I.R.E enthusiast.

But before we move forward and divulge our cost of living. i will digress into the philosophy behind our family’s spending.

Philosophy Behind Our Cost of Living

Q What is Your Approach toward budget and spending

A: When we started our FIRE journey we created an excel sheet and budgeted every aspect of our spending. Over the course of 4 years we have looked at our spending habits and have diverted our money where we get maximum satisfaction or return on our spending such as comfortable home, good food cooked by a cook, house help to manage house etc.. eliminate or reduce what does not really matter to us that much at this point- International travel, Frequent gadget upgrade, luxury car,Lots of clothes, shoes, eating out more than once a week etc… So now it is a way of life rather than a depravation.

Q Do you have a motto to save more?

A Yes and it is:

- De-clutter your house, and mind.

- Only buy what you need and buy it of high-quality.

- Do not buy in a hope that you will use that item someday in future. We live in a highly connected digital world where if needed you can buy things from another continent. So, do not hoard things for a one off future occasion.

- Don’t mindlessly add new stuff in your house. You need less than you think you need.

- Look for satisfaction outside of shopping or collecting things.

- Enjoy what you have, take maximum comfort out of your belongings. Cherish them!

Q What are you trying to achieve by doing this?

A We are trying to balance personal freedom, work, time, happiness and money. So that we can minimise the regrets in life.

Q. Is this the only way to achieve all that you mentioned?

A No, there must be many ways. But this works for us.

Q. Will you always maintain this Cost of Living?

A No. In future depending on our income, and other life goals. We may reduce or increase our spending. We definitely want to do some travel in the future. So, that will take much more money than we are spending currently.

So here goes…

Our Annual Cost of Living, for a family of 3 in Goa, India

Below is the snapshot of our cost of living break-up from the budget and expense tracker app we use. It is free to use and we have written how to use it in our blog post Track Spending to find Savings.

Cost of Living- category-wise break-up

This is a cost of living in Goa for a family of 3. We have covered our biggest expense categories here: Some other Important Categories which are not in the above infographic are:

Some other Important Categories which are not in the above infographic are:

- Insurances-: 4.2%

- Transport- 2.6% (Mainly fuel and car service)

- Clothes, shoes & personal effects- 1.4%

- Gifts- 1.1%

- Entertainment- 0.4%

Cost of Living- Category Details

Rent : 22.6%

Rent is the biggest chunk of our monthly expenses. Rent from our own apartment offsets 55% our outgoing rent. You can read more about our lifestyle Photos of our current lifestyle

We live 10 minutes from beach, surrounded by beautiful cafe’s, art galleries, joggers park etc..It is a very convenient location as everything from movie theatre, shopping mall, restaurants, our doctors is within 3-5 kms radius.

Pregnancy & Delivery expenses: 12.4%

We had our baby this year! You can read the detailed break-up here Our Pregnancy Expenses in Goa, India. Do check it out we have covered detailed costs in it. We tracked everything we spent during 9 month pregnancy- including tests, medicine, doctors consultation as well as delivery costs. Overall we had very pleasant pregnancy.

Home improvements before baby 8.7%

We anticipated our parents’ extended stay to help us with the baby. So we made guest bedroom little more comfortable, added a T.V so our mothers’ won’t miss their daily soaps:). The T.V is rarely used with baby taking up everyone’s time. since there is not going to be much resale value, it will sit on the wall laughing at us. Plus whats wrong with the Cable Tv programmes these days? hardly anything worth watching.

Groceries, Fruits & Veggies: 10.9%

The chart above does not including fruits/veggies and only shows 8% cost of groceries.We primarily cook north Indian south Indian and Chinese food at home and on occasion try the world cuisine. So we end up buying some expensive ingredients.

Maintenance, Repair, Replacement: 7.7%

The biggest spending here was a replacement Mac laptop for Sugandha & extended warranty for Naren’s Mac laptop.

Household help: 7.3%

We have a cook for all meals and she also does our laundry washing and ironing. Another maid for cleaning the house. A Japa maid to oil massage our baby for the first few months. A Car cleaner to clean our car daily as we do not have a covered car-park.

Yes! from doing everything ourselves in our previous house in a Goan village we’ve now decided (after serious considerations) to outsource all household work so we can focus instead on our business and giving the baby the parental attention he needs.

Kid’s expenses: 5.8%

This includes things we bought such as baby cot, cradle etc as well as vaccines, diapers all fall into this category. This expense category began since baby arrived in September, 4 months back. Biggest expense growth will happen here in the coming years!

Food & Drink a.k.a eating out: 4.7%

We managed to keep this moderate or so we would like to believe. It is a personal win for us. We wrote about our struggle with reducing eating out expenses in Developing Good Habits- My battles and learnings

Insurances-: 4.2%

It covers our life, health, home, car and accident insurance. We can not emphasis enough on the importance of taking appropriate insurances to protect your wealth.

Healthcare : 3.5%

This is the money we spent on Ayurvedic treatments/ supplement during Pregnancy. This was totally discretionary and something we believe would help us have a healthy pregnancy and baby. Besides this we did not have any other major health issues.

Transport- 2.6% (Mainly fuel and car service)

For the amount of driving we do this number appears big to us. How much do you spend on petrol?

Clothes, shoes & personal effects- 1.4%

We both bought clothes and shoes. We are again proud of this low number. We are heading towards minimalism. We are focusing on buying good quality pieces that we can enjoy for long time to come. Suddenly I am realising how difficult it actually is to find good quality stuff that will last. But some brands that we enjoy and seems to last exceptionally well are: Cotton World, Arrow and Indian terrain.

Gifts- 1.1%

Gifts to family and friends on birthday, anniversary and visits. This usually also includes the donations we make to charities on our birthdays as a family tradition. But we did not make any in 2018, we realised this as we were writing this blogpost :-(. So this number should go up in future

Entertainment- 0.4%

We did not spend much on entertainment either. We saw two movies in the theatre and the rest is annual subscription for Tata sky (new connection) and Amazon prime. We did not have to try hard to keep this number low because where we live there is a lot of free high quality entertainment available.

Our Cost Of Living Implication for Early Retirement

Q: Your family’s expenses do not seem frugal at all!

A: Our first year expenses in a Goan village was almost 1/3rd of this. Expenses were low because we both did all the cooking, cleaning and gardening etc….We also made some bad choices to keep the expenses artificially low- we would delay car service, repairs to electronics etc to keep expenses low. We would cook Maggi noodles from home to the beach and bring our own beach umbrella instead of eating at a beach shack.

While it was fun to experiment in the early years of F.I.R.E we both decided not to artificially lower expenses just to keep our 25X target corpus low. In the end we’ll also have to live our post-retirement like pre-retirement for the corpus to work. So above lifestyle expenses are more realistic based on our comfort-level at this stage in our life.

On quora somebody rightly said one can live in even Rs 10,000/pm in India and for someone even 1 lac is not enough. A lot depend on your lifestyle and life events

This is a good lesson for anyone who has a plan of retiring to their native village or town to keep retirement expenses low in old age. Better to settle where you’ll have the appropriate support system needed for your life stage.

So, we recommend you to also find a sweet spot for yourself and have a reasonable goal for higher chances of success.

Q Is your target corpus 25X of the above annual expenses?

A: Yes and No. Not all of the above expenses will be incurred in Retirement especially Rent(or EMI) since we’ll be living in our own house by then. To know more about 25 X, read this and this.

Outlook for 2019:

- Kid’s expenses will grow. We did not anticipate expensive monthly vaccines. Expecting more surprises 😉 Might need to hire a nanny once our mothers’ return home.

- Our Chennai apartment’s maintenance will kick in after the association resolves pending issues with the builder. An extra 40K annually.

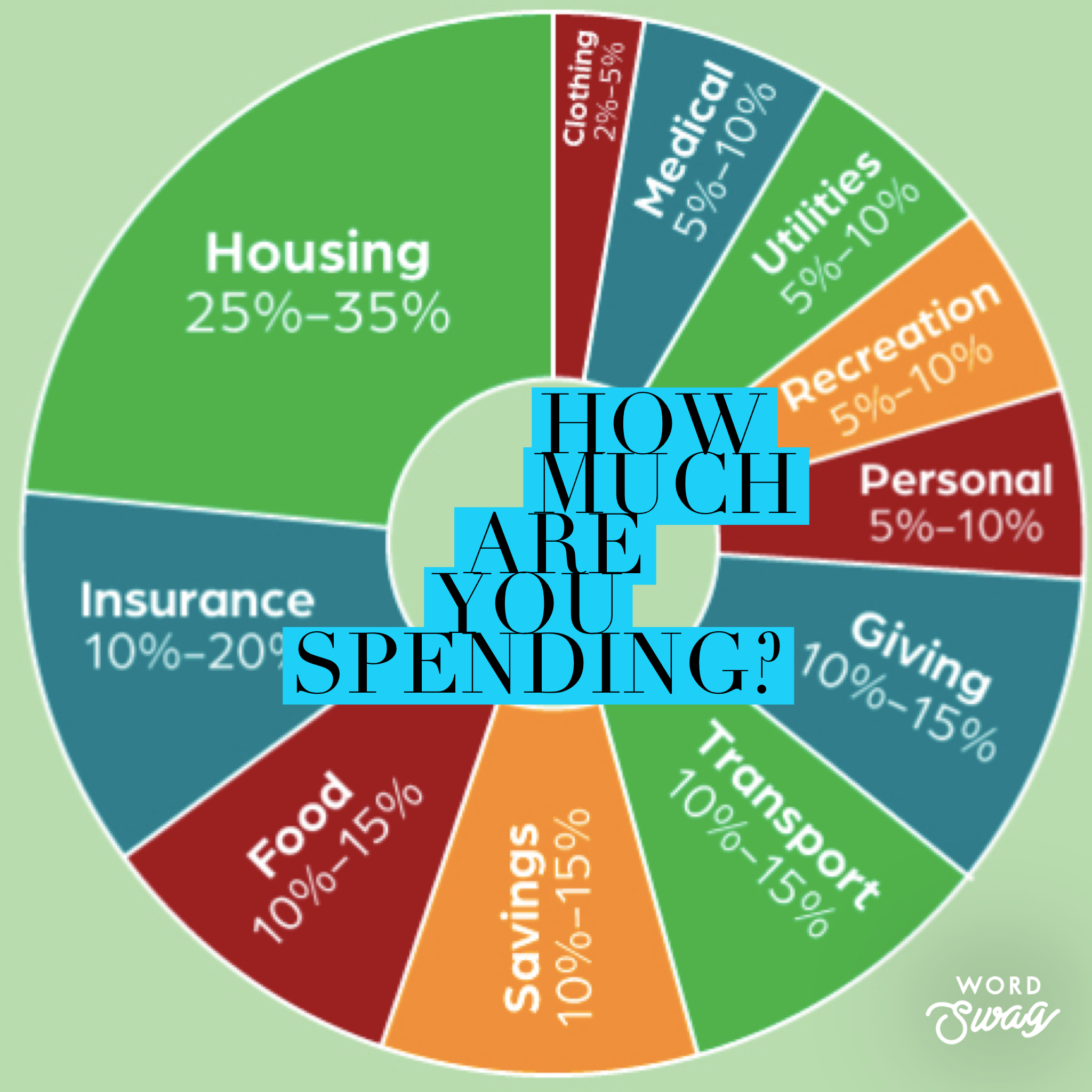

11 Recommended Budget Percentages by Category

This graph is by Well Kept Wallet. This chart is a % of earning. We have spent less then ideal in most category. Under food we are just about in the upper limit.

Also like any FIRE aspirant our saving rate is higher than ideal recommendation.

Tell Us in comments which category do you spend way more than ideal?

Also feel free to ask us if you have any questions and share your ideas in comments on how you maximise your lifestyle while pursuing F.I.R.E?

ENJOYED READING THIS BLOG POST ?

Subscribe by E-mail for more awesome information on Early retirement, personal finance and our life in Goa!!. We publish one new post every week!!! Its Free!

Show your love on social media:

If you like our blog posts! please do LIKE and SHARE it on facebook, twitter or whatsapp!

Source

Source

Hi,

I have been planning early retirement for years and we zeroed down to settling in Goa. I stumbled upon your post on Quora. Your journey is very close to what i have planned with the only major difference that I want to buy Land and construct a house in Goa.

Here is what i have planned, as per my plan I need approx 2.5 cr. I will achieve savings of 2.5 cr. end of this year/early next year (We are 33-34 and plan to be FI before 35 so very close). Then we plan to take Sabbatical and come and live in goa for a few months on rent.

The break up of 2.5 Cr. requirement (as per my plan) is as following:

Goa Land 6,000,000

Home Construction 4,000,000

Swimming Pool 500,000

Solar (10 KW) 500,000

Water harvesting 30,000

Electric Car 1,100,000

Bed (4 Nos) 100,000

Sofa 100,000

Fridge 25,000

Washing Machine 15,000

Furniture 100,000

Woodwork 100,000

AC 150,000

TV 25,000

Kitchen 300,000

Vacation Kitty/

Contingency 10,000,000

Retirement (NPS) 2,000,000

Total Cost 25,045,000

Basically i am keeping 1 Cr. for Vacation/Contingency (We are fond of traveling both domestic and International) and would leave 20 lakh in NPS account for the old age days.

Now we don’t plan to retire but like yourself we want to do job we like with little stress. I assume between me and my wife we should be able to earn at least 80k /month if not more. The monthly expenses i am assuming are as follows:

Rent 0/ 30,000 (0 in stable state when i own house or 30 k in transition)

Investment for Son 12000

Restaurant 5000

Maid 5000

Utility Bill (Internet/Water/Electricity) 5000

School 10000 (10,000 in stable state, 0 now as Son is less than a year old)

Food/Groceries 10000

Shopping (Cloths etc.) 10000

Insurance (LIC/Life) 3983

Health Insurance 1000

Misc 7000

Total Expenses 68983/88983 (Stable/Transition Period)

Do give your feedback on the plan/expense i have thought? Like you i started 10k SIP for my son’s education before he was born..will increase it a bit (read your other blog on college education expense).

Hello,where in North Goa do you guys live and what would be the best area in North Goa to buy a flat ?

Hi Naren, where do you live in Goa?

Hi Nitin, we live in north Goa

Very interesting read with the contribution form everyone.

I am currently living in US and plan to move back to India (Chandigarh, Punjab area) with wife and 5-yr daughter.

Below is what i have budgeted-in (monthly).

Ltt me know what you think i may be below or over or missing.

TOTALS Rs 174,550

0-Dairy Rs 5,000

1-Meat Rs 1,000

2-Fruits Rs 3,000

3-Vegetables Rs 3,000

4-Dals Rs 1,000

5-Other food Rs 10,000

6-Misc (household) Rs 8,000

7-Misc (personal) Rs 3,000

Cylinder Rs 2,000

Restaurant etc Rs 10,000

Rent (owned flat) Rs 0

Flat maintenance Rs 4,000

Property Tax Rs 0

Elec Rs 7,000

Maid cleaning Rs 2,000

maid cook/clean Rs 2,500

maid laundry Rs 500

driver Rs 15,000

Internet Rs 2,000

Mobile Phone Rs 2,000

Cable/Dish Rs 1,000

Ironing Rs 500

Health Insurance Rs 3,300

Life Insurance Rs 2,000

Medical Expenses Rs 2,000

Clothing Rs 4,000

Footwear Rs 2,000

School Tuition/Books/uniform Rs 10,000

Extra-Curri Activities (kid) Rs 10,000

Fuel, 2 cars Rs 8,750

Auto Insurance, 2 cars Rs 4,000

Auto maintainence, 2 cars Rs 1,500

Travel – Airfare Rs 13,500

Travel – Hotel Rs 8,750

Travel – Restaurant Rs 5,250

Gym, 2 ppl Rs 3,000

Parlour Rs 2,000

Other Rs 7,000

Bribe Rs 5,00

Annual Travel is budgeted as monthly item.

Incredibly detailed budget Amrit – a man after my own heart! Tough to review at that level but you’re probably being a bit conservative here. Some that strike me as such: Dairy, Cylinder, Electricity, Mobile phone

However, if you’re coming back after a while, it’s better to be conservative and let things work themselves out. By the end of a year, you’ll have a better idea of what the real expenses will be. You’ll probably end up spending less on some of the items you’ve budgeted and more on some things you haven’t thought of like say jewellery, electronics and end up around the same level. Overall, I seriously doubt you’re going to end up spending more than this at a middle class lifestyle.

One point though on tracking. If you want to keep track at this level, it’s going to be very difficult unless you’re really meticulous. Indian credit cards don’t produce the quality of reporting you’re used to in the States so you’ll have to use independent apps and train them to understand and classify vendors. Cash expenses will obviously be totally manual. Maybe you should consider grouping the expenses a little less detailed to make it easy for you to track.

Amrit,

Rs.1.75 lakhs per month is a comfortable number for a family of 3 in India

Mentally you should not be surprised if it goes up to Rs.2 lakhs/month once you actually start spending here.

Having a driver is a very smart thing to do when you are newly returned to India.

Some expenses seem less

for example:

– property tax cannot be zero

– cook’s budget seems less. if they are cooking more than one meal I would expect it to be double your budgeted amount.

– electricity you might want to check the summer rates with A.C running or charging the inverter

You might have some India-specific expenses:

– Gifting : since you’ll visit family more often, birthday party of kid’s friends

– Festival Bonus for maids, driver etc. In some cities the bonus expected is one month’s salary.

– Backups like inverter, internet dongle etc

– one-time house setup costs like furniture, kitchen items etc

Bottomline:

Come here expecting that some expense items will cost more than your budget.

Don’t fret too much as it is what it is.

You’ll figure out ways to cut expenses once you are here and adapt to India.

The Indian context is so unmissable in the expenses. Can we possibly try to live the European way in India? Might be a challenge keeping the Indian sensibilities in mind, but will be worth a try. Maybe we will save even more.

Hi Ps, we tried to live like Europeans when we first started out. But we could not sustain it. We were spending way too much time on chores. You are right, for a developing country we still got many luxuries in terms of hot food, ironed clothes etc etc while growing up curtesy our mother’s. now we are used to all that good stuff and suddenly as an adult it is difficult to make that shift permanently… both me and my wife were unhappy doing most of house chores ourselves. If you give it a shot do let us know how it goes?

Would you be able to put some absolute numbers on what is your target corpus?

The numbers published in all online resources seem to indicate more than 40 x times the requirement as retirement corpus. For. e.g. the times wealth of this week had an article where the persons retirement corpus in 20 years was approximately 4.8 crores and his montly outgo was not even a lakh. (calculated with inflation of 6%)

How do you justify just 25x the total outgo per year as your corpus requirement?

Hi Mahesh!

We do not promote 25X to retire early. How did you get an impression that we do?

In our blog post How much money I need to Retire Early In India we have clearly stated:

We recommend and use 25X corpus to shift life gears into doing things you always wanted- business, new job with less salary, travel the world while still supplement it with passive/part-time-seasonal income.

here I have picked few lines directly from that blog post:

Neither of us is in jobs we don’t like, because we shifteD our life gear with 7X our annual expenses. But we did feel pressure because of low savings- we were bit young and we thought we could swing it! we eventually did! But we do not recommend it to others. We recommend 25X instead of 7X to take a pause in your life to align your work and life to your belief system. NOT TO RETIRE FULLY.

We recommend 40-50X annual expenses for full retirement, depending on what age you are planning to retire.

We have not read the article you mentioned, perhaps you can share a soft copy with us.

Hope this clarifies your doubt?

Hi Mahesh,

Naren’s given a pretty clear answer but I thought I’d piggyback on your question to put my own retirement budget, corpus and assumptions up for scrutiny and see what input Naren or any other smart reader can provide

2 parts to your question so here’s my response

1. My target corpus. Here’s my retirement expense estimate if I were to retire today.

Expense Head Monthly Annual

Education 20 240 (My kid will only be 8 when I hopefully hit FI)

Flat Maintenance 10 120

Domestic Help 10 120

Grocery & Provisions 10 120

Dining 10 120

Shopping 10 120

Bills/Utilities 10 120

Kids stuff 5 60

Fitness/Beauty 5 60

Car/Transport 5 60

Entertainment 5 60

Gifts 30

Charity 30

Insurance 30

Medical 30

Misc 80

1400

Capex 300

Travel 300

2000

So my corpus estimate is 25X 20L i.e. 5Cr. I have a separate target of 50L for my daughter’s education and 50L for her wedding.. All the numbers face inflation at various levels, so my actual corpus requirement when I hit FI at 45 will be 8.25Cr rather than 6Cr.

2. Why do I feel 25X is sufficient?

I think Naren’s answered that pretty well. 25X is not 100% safe. When I put the numbers into an US FIRE (unfortunately we don’t have calculators as good here) calculator, with a 50-50 Debt Equity Mix, it only comes out 95% safe for a 45 year horizon (until I turn 90). So why am I comfortable with that?

a. I’m mainly talking about FI not RE. I’m hoping to use reaching FI as a trigger to switch from a job I’m not enjoying doing to something that pays less but gives me more of a worklife balance and allows me to do what I want to do. So I’m hoping not to be totally relying on passive income. Plus my wife’s not in the same boat as me. As of now, she has no intention of retiring in 4.5 years and wants to continue working.

b. I have not considered any buffers – for example, I own a house in Mumbai where I have no intention of living. My intention is to sell and utilize part of the money and buy a house somewhere I intend to live permanently. Given the value of the Mumbai house, there should be a substantial surplus which would add to my retirement corpus. There are a couple of smaller buffers as well that I’m keeping in reserve

c. If everything goes wrong – I can’t find a job for 5-6L, my wife also loses her job and the market takes a bit of a dive, I have my ultimate trump card – my expenses. I know my expenses have plenty of bloat. With minimal adjustment to my standard of living, I can drop my expenses by 30% – no foreign holiday, slow down big capital expenses, cut down a little on expenses such as dining, entertainment and shopping. My adjusted budget would be 14L and suddenly my drawdown rate is lower than 3% which gives me a 100% chance of making it through to 90 with something to spare. Not something I’d like to do admittedly but definitely not out of the question.

Sorry my expense table came out looking ghastly. It was an Excel table but I couldn’t find any way to format it here.

The information is fantastic. Thank you for sharing it

What do you use to keep track of your budget and spending?

Thanks Naren…I’d really appreciate your thoughts on this. Anything obvious I’m missing, anything silly I’ve included etc.

I use an app called Moneyview. Been using it for 4 years now so it’s pretty well set up. I use minimal cash – maybe 10k a month so all the SMSes from the Credit card get sorted automatically. Only effort I have to make is on cash and vendors like Amazon which could fall into multiple categories. I have a pretty good handle on my expenses now.

Anil, You had me at CapEx and Buffers 🙂

I’m surprised though that your insurance is low at 30K/year especially if it includes all insurance like Health, Life, Accident, Home etc. Since you mentioned you dropped life insurance I’ll refer you to another FIRE expert’s take on this: https://retireby40.org/do-you-need-life-insurance-after-early-retirement/

tldr; life insurance proceeds helps tide over the initial chaotic period of sorting out financial matters in one’s absence.

From our experience, reducing expenses post-FI is very difficult as home electronics/car etc decide to break down (CapEx) when you least want them to.

So “Don’t plan on expenses going down post-FIRE”. Other than big discretionary like international travel, expect other categories to simply redistribute themselves post-FIRE. like commuting costs will go down but since you are running A.C at home your electricity costs will go up Or you might rent a co-working space etc.

Don’t count any employer-provided benefits that you’ll lose once you quit your job like group insurance, rental allowance, travel reimbursement etc.

Since starting this business, I realised that you can have a better work-life balance as long as you are not dependent on regular salary income. That is where FI makes a big impact. If you can cushion the lean months you can reel in fat months. Counter-intuitively when out of a job you might need to “invest” money for skilling/marketing/hiring employees etc. Hiring employees is the best solution to get better work-life balance even when you are planning to fly solo post-FI. So I would factor that in as a non-obvious expense item separate from household budget.

You definitely won’t need to rely on your corpus from age 45 to 90 given your work experience and your wife also being an earner. So at some point Excel modeling has to stop and you have to trust your ability to generate income based on your track record.

Our approach is similar to yours : Passion-filled FI is as good as Passive RE

p.s:

“You had me” reference link 😉

You had me at Hello from Jerry Maguire:

https://tenor.com/view/jerry-maguire-romance-comedy-renee-zellweger-you-had-me-at-hello-gif-3393630

Thanks for the comments Naren. I’ve thought about insurance.

– Health is pretty well covered

– I had a 2 Cr Life but as I said earlier, I closed it out this year. I don’t think 2 Cr extra will make any significant difference to the quality of my wife and child after I’m gone given what they’ll inherit anyway. It’s not a huge cost though so I’ll give it another thought given your point about the immediate transitionary period

– Home insurance seems absurd. I’ll comment on it separately in your post on that

I get your points about needing to take the plunge at some point. I only hope I have the guts and don’t chicken out when I hit the targets in terms of age and corpus that I have set for myself.

Thanks again.

Anil, you misunderstood what I meant by “excel modeling has to stop at some point”

I was not goading you to take the plunge once you achieve your target corpus 🙂

Instead I was referring to your statement that “if everything goes wrong … : you are unable to find a job, wife loses job and market tanks all at the same time.. SWR of 3% will take you till age 90”

That seemed to me like an over-reliance on Excel-based SWR

Realistically even if everything does go wrong the bad times will not last for decades at a stretch.

That is what I meant by “You definitely won’t need to rely on your corpus from age 45 to 90 given your work experience…. at some point Excel modeling has to stop and you have to trust your ability to generate income based on your track record.”

To be frank Anil, “taking the plunge” is a bit overrated.

because it suffers from survivorship bias. the ones who drowned are not interviewed in the media.

More than your FI corpus, what’ll probably give you confidence to “make the switch” is when you taste success in your post-FIRE choice of work.

You can make some smart moves way ahead of time to dip your toes into post-FIRE work before actually quitting your job.

For example:

– Getting your consultancy setup while still working .. lining up clients, hiring employees etc and quit only after it works out.

– Mentoring/Advising individuals or companies in your target post-FIRE domain so they are ready to hire you the moment you quit

– Negotiating a sabbatical for a year from your current employer and working on your idea etc.

Thanks for bringing out that point mahesh,

I have also seen many articles in ET plan section recommending 4-5 CR as retirement corpus for average 50-60k Expenses

@Naren what are your view’s. I feel some Expenses will go down and as Anil mentioned its Mostly about FI than RE as we intend to do something which we like but may not give money what we get now

Also we can plan in a way that 40% expenses will be taken care through passive income e.g rent etc and 60% though what we intend to do (Business/job we like)

Hi amrut,

Take a look at your retired parents expense breakdown to see if their expenses have gone done drastically post-retirement. I bet you’ll see that while certain categories have gone down like child-care & commuting, other categories see a massive spike like healthcare & travel. Leaving their expense situation almost the same as they were before retirement. Now if this is the situation with our super-thrifty middle-class parents, I’m skeptical that our generation will be able to cut down expenses post-FIRE.

Check out my reply to Anil’s comment thread on expenses. reproducing relevant excerpt below:

From our experience, reducing expenses post-FI is very difficult as home electronics/car etc decide to break down (CapEx) when you least want them to.

So “Don’t plan on expenses going down post-FIRE”. Other than big discretionary like international travel, expect other categories to simply redistribute themselves post-FIRE. like commuting costs will go down but since you are running A.C at home your electricity costs will go up Or you might rent a co-working space etc.

@mahesh & @amrut

So with this realisation about expenses not going down in mind, we recommend 25X + meeting expenses by working on your own terms post-FI. Because compounding favours a large corpus, 25X will compound faster into 50X than the time it took you to get to 25X. For example: Even if you add nothing to the 25X corpus it will double to 50X in 20 years from age 45 to age 65 assuming you get only 3.5% CAGR return. See: http://www.moneychimp.com/features/rule72.htm

To compensate for unpredictable market downturns we recommend you save regularly even after 25X however small the SIP.

Hope this clarifies our approach.

This is the kind of discussion I love.

I can’t post a table here as it’s only text but I’ve just finished my analysis for 2018. My budget was 20L but disappointingly, I’m over budget by 2.3L. Consolation is that this was an international travel year (we do alternate years for international travel) so as long as our domestic holiday is reasonably priced next year, we should recover somewhat.

Rent 16%

School & Daycare 9%

Utilities & Bills 5%

Provisions 5%

Domestic Help 6%

Dining & Entertainment 8%

Car & Petrol 4%

Clothes 3%

Fitness & beauty 2%

Domestic travel 2%

Charity 2%

Gifts 2%

Insurance 1%

Medical 1%

Miscellaneous 3%

Holiday Travel 22%

Capex (Car, furniture etc.)9%

Setting aside the travel thing, I’ve realised I’m mainly overbudget on Dining/Entertainment and Clothes. Either need to relook at my budget or start reining some of that in. I guess the longer term issue is that my FI calculations are based on a 20L current spend. I may have to look at them again to build in some buffer.

Savings stayed solid this year mainly helped by it being our first full year of dual income after a 3 year break for my wife as well as some nice bonuses at my work.

Overall still just about on track for FI at 45 but it would really help to have an underbudget year next year to reassure myself.

Seems to be short on insurance

Yep. Big milestone this year – dropped my life insurance! Even after calculating very conservatively, I figured that if I popped off tomorrow, my wife and daughter would have to make zero adjustment to their lifestyle if she stopped working and chose to live off the savings stash.

Part of my FI at 45 plan. I’m at 75%+ of my target stash and my dropping off the expenses would take it well above 100%.

So the only insurance left is a medical insurance that I bought 4 years or so ago and is on top of both my and my spouse’s work insurances. I add Car insurance to the car costs.

Anil.. You are having an expenses of 20L a year in 2018 and are talking of early retirement !!! you already seem to be a rich guy man !!!

Even with a moderate 6% inflation, your expenses after 5 & 10 years 27 lacs & 36 Lacs respectively.

Ha…thanks B but if there’s one thing I have learned after 18 years of working, it’s that concepts like “high salary”, “rich” etc. are all relative.

In college, I thought all would be great when I had a credit card. Whe I was earning 3 lacs, I thought all my problems would be solved when I reached 10 lacs. At 10 I thought, I’d be rich when I was worth 1 Cr and so on and so worth.

What is enough and satisfactory for you can only be determined by you.

Rent : 24%

Electricity and flat maintenance :8%

Child school /daycare/uniform/school incidentals :22%

Insurance (all):8%

Petrol and car mainentance : 6%

Domestic help:5%

Medical:5%

Digital:3%

Groceries:10%

Eating out/entertainment/shopping/personal :11%

Hi Abhishek, Thanks for sharing this information. what do you use to keep track of your budget and spending?

Honestly don’t track it to last mile. As you can see almost 80-82% of expenses are fixed. Sips gets done one 1st, major expenses by 7th.. so we don’t really track it.. we have a 50-50 ratio of expense and saving so what ever has to be spent will be from 50%.

Any leftover gets invested

Okay I understand. Thanks for sharing A.