Savings = Income – Expenses. It is the time to talk about the Expenses part of the equation. Once you understand your expenses, you can control them. Understanding what you spend on is the key to increase your savings and in this blog post I will share with you how we do that.

“They say money talks, but all mine ever says is ‘good-bye sucker.” Jill Shalvis

If you relate to this quote by Jill Shalvis, keep reading:-)

What I use to track our spending

I use a great app call Spendee to track my daily spending. It is a free mobile app and I am using it for 3 years now. I can access all my past spending in different permutation and combination, which is a great help to track our family’s spending and inflation trends.

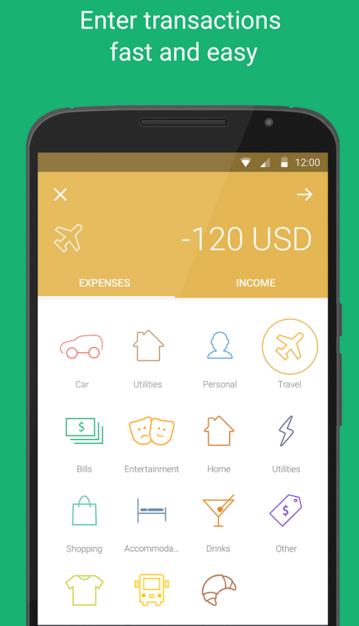

It is a easy to use mobile app, it takes only few seconds to add a transaction. See screenshots below for how to use it. You can change the currency to INR, once you download the app.

How I use the Spendee to keep tab on our spending

- Whenever I buy something I immediately open the app and add the expense under the category

- For known expenses like rent, phone bill etc, I add a recurring expense each month

- For annual expenses where I pay upfront like health insurance, I break it down into monthly recurring expense. This is so I know my monthly budget. Beauty is : On Day 1 of every month, all these recurring expenses are shown immediately on the app. So I know how much money I’m allowed to spend for the rest of the month .

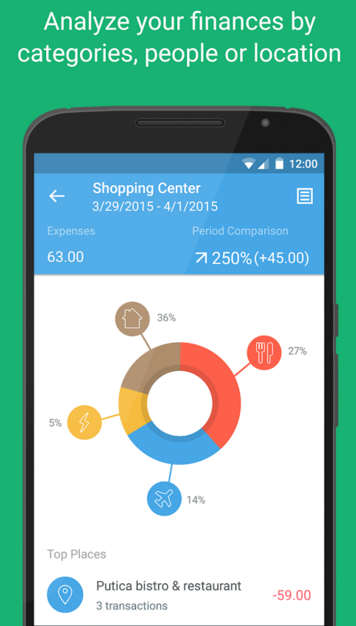

- At the end of the month I check if I’m under-budget for the month. If not I check each expense category to figure out where I went over.

- Additionally, we also analyze whether we can save money in each category. We recently discovered that we would save Rs.1000/month by upgrading to a different internet plan since we were paying extra charges whenever we went over our current plan’s limits.

Pros of using Spendee:

- Free

- Multiple family member can access it from their phones to input their spending

- Does the job

- Can set currency to Indian Rupee.

- Has more advanced features if you need them.

Cons of using Spandee:

- Manual entry : Minimum 3-4 of clicks to add a single expense. An app idea I just had : option to just enter the expense amount and app uses location info from phone to figure out if it was a restaurant, market etc 🙂

- Needs a Budget limit function for each category and total budget per month. That way I can know in real-time if I’m under-budget for a particular category and for the month.

****Update-5-July-2018 *****

Couple of readers in comments have recommended another APP called Walnut which allows you to add budget. I have personally not used it so far, may give it a try in future. But changing app is a bit of a work, as my old data would stay on spendee.

If you are not using any app yet. I would recommend you to do your research and compare all new/old apps available and go with the one which solves all you problems because it is difficult to migrate later as your old data may/may not be transferable to the new app.

Next to Read:

Early retirement in India – Ultimate Guide

Top 5 Reasons to be Financially Independent and Retire Early

[…] Below is the snapshot of our cost of living break-up from the budget and expense tracker app we use. It is free to use and we have written how to use it in our blog post Track Spending to find Savings. […]

[…] is the only thing under your control so tackle this first. Analyse your lifestyle using apps like Spendee to cut down wasteful spending without being “penny wise and pound […]

Just reading all of your articles now. I’ve been using an App called Moneyview which does most of the stuff that Walnut does but doesn’t look as pretty. I’d like to switch to Walnut as well but I’ve got 3 years of historical data on Moneyview which makes it very difficult to switch.

hi Anil, yes not having historical data is hard. perhaps you can start tracking expenses in the new app of your choice without uninstalling your old app. That way the new expenses will be in the new app and historical expenses in the old app

I think I’ve become used to Spendee now 🙂 so a bit of inertia to switch. But I’ll try Walnut based on your recommendation. thanks!

you can use Walnut app…it basically does the same thing and also scans your messages to automatically add the expenses whenever u do any sort of transaction. Plus you can set your budget for the month.

Basically all your cons can be resolved if u use Walnut.