In this guide we will share how we discovered Early Retirement, and a step-by-step plan to achieve early retirement in India. As a bonus we will also share our own early retirement journey with you. By the end of this guide you will fully understand what Early Retirement is and how can you achieve it.

TABLE OF CONTENT

How I Discovered Early Retirement?

- GRADUATED INTO RECESSION- I graduated in computer science straight into a recession caused by the double whammy of the dot-com bust and the 9/11 attacks. My father had recently retired from his public sector job and I did not have any job offer on hand as campus hiring dried up completely. It felt like I was being tossed around by economic forces beyond my control.

- JOB WAS FRUSTRATING: When I finally entered the workforce at a Big Company, I was soon frustrated by the usual job stress and job insecurity.

- LIVING A START-UP DREAM: I decided to end this “working for money” problem once and for all by joining an early-stage internet startup. Joining a startup was also my dream since college and I had plans to start my own later. The idea was when the startup will sell for millions, I would strike it rich and never have to work again. Well… 6 years later when the startup was sold, my services were no longer needed. I was out of a job without striking it rich 🙂

- AHA MOMENT!!!: Around this time, I discovered the early retirement community online that talked about focusing on the one thing I could control: my savings rate. All along I had focused on things outside my control and failed to solve the “working for money” problem. Out of all the options available to salaried employees to achieve financial independence, early retirement offers the highest chance of success because its success or failure is under your control: how much you save each month Share on X

- WORKING ON EARLY RETIREMENT RELIGIOUSLY: Soon after that we got married and both My wife and I joined hands to pursue Early Retirement. Together we spent countless hours to understand if Early retirement is possible in India. It has now become a way of life for us.

This guide is a result of hours and years of brainstorming of how one can achieve financial freedom and retire early in India.

What is Early Retirement?

Most of the Early Retirement literature online is from the U.S which is understandable because they have a longer history of regulated stock markets & mutual funds compared to India.

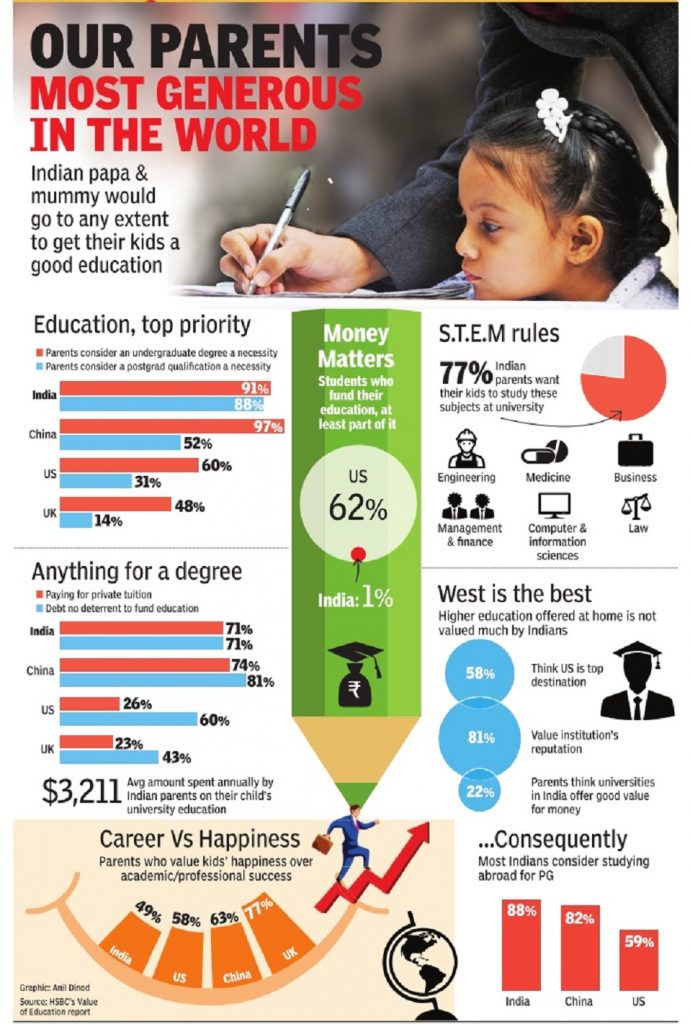

In this guide we’ll do our best to translate Early Retirement for Indian conditions as we have our cultural differences when it comes to money. We pay for our child’s college, we live in joint families where we also take care of our raging parents.

If you are well versed with early retirement concept. You can skip to the next part

Early Retirement In Theory

- At age between 30-50 when you are able to meet all your living expenses through returns from investments like Real Estate (rental income), Mutual Funds, Stocks (dividends) etc. Also known as passive income.

- So you don’t have to actively work anymore to meet your expenses.

- You live on investment returns post-inflation so your corpus will last forever beating inflation…theoretically.

Early Retirement in Practise

- In reality people understand that if you retire early at age 30 or 40, you have 50-60 years to live after retirement.

- So, to be safe and not bore to death :-)Early retirees develop a skill or hobby that they enjoy and which brings some cashflow to supplement their Retirement corpus.

- So, most Early retiree do work, but in alignment with their life goals for example:

- To do something they love

- To earn money without stress & more work-life balance

- To lead a healthy & active lifestyle

Read more on The basics of Financial Independence and Retiring Early (F.I.R.E)

Disclaimer : This article is purely the author’s personal opinion. The author is not a certified financial planner. Seek the help of a certified financial planner for your individual situation.

Without further digressing let us get back to the business. If you have read up until here then you are really looking forward to Early retirement in India. We will tell you exactly what you need to know. Keep reading.

Math Behind Early Retirement

When everyone works till age 60, how can someone retire at age 30 or 40? Math is simple.

- Invest a large enough Early Retirement Corpus in assets such as Equity, Debt and others which give you average annual returns of anywhere between 9-10% before inflation.

- Assuming inflation at 6%, you are left with-3-4% returns after inflation to live on.

How Big Should Be Your Retirement Corpus?

- Take your annual expenses at the time of Early retirement and multiply it to any number between 25-50 to derive at your retirement corpus. Share on X

- In ER community 25 Times your annual expenses is the minimum amount of corpus recommended to call yourself an Early Retiree.

- Read our blog post How much money you need to Retire Early in India which will help you to decide on your retirement corpus.

(Not convinced you can save that much money, keep reading. We will tell you how to do it. And also share stories of two people who have done it)

- We are targeting 25X as a starting target but will be most comfortable hanging our boots fully when we reach 40X.

- However, we may take sabbatical or travel the world once we reach 25X. Check out our Semi-F.I.R.E lifestyle in Goa.

Making sure your Early Retirement Corpus will Last your lifetime

You have spent a decade or two saving up for your early retirement. Now how to be sure if you have saved-up enough or not?

“Safe Withdrawal Rate” answers this particular dilemma: How much can you spend in Early Retirement based on your savings.

In our blog post How long will your money last in Early Retirement we introduce our reader to a concept called “Safe Withdrawal Rate” (SWR).

SWR is a conservative estimate of how much you can safely withdraw annually from your nest egg without exhausting it completely before you die.

SWR approach balances between you having enough money every year to live comfortably after early retirement without depleting your corpus prematurely. Share on XNot convinced that Early Retirement is possible in India? Markets are too Unpredictable, what if something goes wrong etc…

Our Experiment Shows Early Retirement is Possible in India

We did an experiment in our blog post How long will your money last in Early Retirement. Where we assumed:

- 50/50 stock/debt portfolio

- Person retired with 25X corpus of 3 crores, based on Rs.12 lakhs annual expense.

- Withdrawal Rate is 4% in all scenarios

Tested these assumptions on different portfolio return:

- 2% Real Rate of return*- 3 crores lasted for 34 years.

- 3% Real Rate of return- 3 crores lasted for 42 years.

- 4% Real Rate of return- 3 crores lasted for 64 years.

For detailed experiment visit our blog post How long will your money last in Early Retirement.

*The inflation-adjusted returns is called as “Real Rate of Returns”.

5-Steps to Achieve Early Retirement

-

STEP 1- Target 50% Saving Rate

The biggest difference between Traditional Retirement and Early retirement is Time. If you aspire for Early retirement you have less time to accumulate your retirement corpus or Nest Egg and many more years to live on that nest egg. Share on X That is the reason most Early retirees save aggressively at least 50% of their income early on in their life instead of doing a small monthly SIP with the goal of retiring in old age at 65.

50% savings rate reduces the time to retire.

This is the simple idea behind Early Retirement before inflation & investment returns even enter the picture.

-

STEP 2- Lower your Expenses

This is the only thing under your control so tackle this first. Analyze your lifestyle using apps like Spendee to cut down wasteful spending without being “penny wise and pound foolish”.

For example: In our house we use the internet for entertainment so no T.V or cable expenses, we mainly eat home-cooked food so our eating-out expenses are low, we do yoga at home so no gym fees, we own high-quality phones & laptops that are expensive but we maintain them carefully for years so they work out cheaper in the long run.

It took us almost 3 years to systematically reduce our spending without feeling deprived. Take a moment to think what are the top 3 categories where you could get the same value but for way less money? Share on X-

STEP 3 – Increase your Income

If you’ve cut all wasteful expenses and are still not saving enough then your only option is to increase your income. Your early retirement goal gives you clarity and urgency to do what is necessary to get that promotion or better-paying job Share on X

It will not happen overnight but you can work towards it purposefully now that you have a time-bound reason.

-

STEP 4 – Get out of Debt

Early retirement is about creating passive income in the future.

Debt does just the opposite. it eats into your future cash flows. So, debt is an enemy for Early Retiree. Till the time you crush your debt, you can not become financially independent or achieve Early retirement.

Another reason is debt is expensive. For example: Say you have a 36% annual interest Credit Card and an outstanding balance of Rs.1 lakh on it. If you don’t pay back the debt for 2 years then the credit card balance will double to Rs.2 lakhs.

If you’ve bought a house on exorbitant EMI at an early age, you need to first crush your EMI. If you have an education loan, learn how to crush education loan.

-

STEP 5- Build a Side Hustle

This will reduce your worry if any regarding the safety of your retirement corpus plus keep your mind healthy and entertained. In our blog post Want to Retire Early to Travel the World? we share a few ideas of creating side hustle/passive income.

-

BONUS:-) STEP 6 – Work as a team with your spouse/partner

Get your spouse/partner on board and work together as a team. Read our blog post on how to get your partner on board with your early retirement goals.

If all you want is a couple of years freedom to try your hand at a new career or business, try a mini-retirement like we did instead. If you are debt-free and your spouse’s income can take care of expenses, one of you can quit your job with the safety net of your spouse’s income. If you succeed in your venture and are able to cover expenses then your spouse too can quit their job to follow their dreams. This way both of you can make money doing what you like. Even if you fail in your venture, you can re-join the workforce & try again later.

Why Early Retirement?

Early retirement is not a luxury but Necessity these days

Real-life case study: Headline news about all the 45-year old mid-level managers at TCS/Cognizant/Infosys getting laid off because their industry considers them obsolete and who probably won’t get another job at the same salary for at least another 3-4 years. An emergency fund of just 6-months to 1 year will not help in this case. These folks have been forced to take early retirement.

Companies won't think twice before hiring a younger person with a lower paycheck to replace higher-cost employees. So if you are not absolutely indispensable, Early Retirement should be your back up plan. Share on X If you are not ambitious to achieve it at age 30, age 45-50 makes a convincing case.

5- other reasons for Early Retirement

In Our Blog Top 5 Reasons to be Financially Independent and Retire Early (F.I.R.E) we talk in details of other convincing reasons to retire:

- Because you can!

- Freedom, Courage and Peace – Life keeps throwing curveballs at us, huge retirement corpus at young age is like a massive safety net you can fall back on when things go south.

- F.I.R.E enables your money to work for you- Saving such big corpus early in life provides good base for your money to multiply and grow

- Practise for full retirement- Scaling down your work by 50% by age 40 is a great way to get a preview of what “full retirement” will look like at age 65. You will get a lot of wake-up calls mostly around the state of your health, investment returns , wasteful expenses and whether you really have any true passions in life or were you just lying to yourself about “dreams & passions” to mentally escape from job stress 😉 So while planning for Early Retirement also work on your passion on the side to prepare yourself for the post-40 life.

But Let’s be honest, Early Retirement is not for everyone. some people love their jobs and they want to continue working till possible. In that case, you can at least strive for Financial Freedom.

For everyone else, Early retirement could mean so many things. Here are the Top 10 things you can do in Early Retirement

Our Early Retirement Journey

- In the year 2014, we took a calculated risk to quit our jobs and start own business.

- At that point we had zero debt, owned an apartment and 7 years worth of expenses saved up.

- Fast forward into the present- our business is a success. Business income fully covers our expenses and savings rate is climbing slowly towards 50%.

- We realized if with 7-years worth of savings we can create such a fulfilling life. 25 times savings will take us to an epic level of freedom and security.

- That is how we got glued to F.I.R.E.

- After achieving Early retirement Naren may take up a job at a non-profit at a much lower salary. Sugandha is working on her own and wishes to continue doing it.

- We live somewhat a frugal lifestyle. Check out our current lifestyle here.

So what do you think? Can you also do it? or do you need some more motivation?

Early retirement Success Stories in India

Please check out success stories of Two Middle-Class Indian Families who are very close to achieving Early retirement.

Early Retirement Interview: Mahesh is 5 years away from claiming Early Retirement

Early Retirement Interview: Anil from Pune is 4 years away from Financial Independence

If they can do it, we can do it so can you.

Frequently Asked Question related to Early Retirement

FAQ 1: What about saving for my child’s college expenses if I’m saving first for my early retirement?

We have shared our strategy here- Our Plan to Fund Kid’s College and Recommendation.

FAQ 2: Should I buy a house first or save for early retirement?

- We recommend from personal experience:Don’t buy a house on EMI at a young age in your 20s or 30s when you don’t know where you’ll settle down permanently. We move to other cities and even countries for work these days and there is no knowing ahead of time where you will… Share on X

- Instead, save SIP in mutual funds towards buying a house until you have 100% clarity closer to retirement in your 50s or 60s and then build or buy a brand new house or flat fully in cash without EMI.

- A couple we know are doing exactly this: after traveling all over the world for work & renting throughout they are now building a house in their hometown for retirement in their mid-fifties.

FAQ 3: But we want to do extended travel frequently. That’s why we want to retire early and stop working!

Think win-win: Once you achieve financial independence you can quit your job and travel for say a year. After a year of travel, you can recharge both yourself and your bank accounts by returning to the job market for a couple of years to work on something you enjoy (maybe something related to travel!). Then travel again. Repeat the process until your 60s by which time hopefully you would have traveled everywhere you wanted to and your compounded retirement fund will be waiting for you!

——————–Let this be an End to a new beginning-———————

Ask us any questions or just drop us a hello!!!

We love to hear from you!

ENJOYED READING THIS BLOG POST ?

Subscribe by E-mail for more awesome information on Early retirement. We publish one new post every week!!! It’s Free!

Show your love on social media:

If you like our blog posts! please do LIKE and SHARE it on facebook, twitter or WhatsApp!